Perusduunari muiden joukossa –

2. Wages should be enough to live on

The wages or salary paid for work depend on the line of business and the employee’s duties and performance. The employee’s pay is also strongly influenced by the nature of the employment relationship, whether full or part-time and permanent or fixed-term.

The majority of Industrial Union members work full-time (97%) and in a permanent employment relationship (94%). Permanent full-time employment is slightly more common among men compared to women. Only a small minority (3%) work in a fixed-term job, but fixed-term employment is significantly more common among younger members. Fixed-term, part-time work is uncommon (1%) among Industrial Union members, however.

Various supplements come on top of the base salary or wages, the most important of which is a supplement for shift work. The member survey found that just over half of respondents are in daytime work and the other half in shift work. The ratio is the same as three years ago.

Permanent, full-time work provides stability in the management of daily expenses. Naturally, the size of the household and the number of breadwinners also influence disposable income. For the average worker, costs have also increased in a way that makes it impossible to balance a household budget.

Significant increases in expenses

Living costs have increased tremendously over the past couple of years. At the time of the member survey, consumer prices had spiked in the past year. Inflation stood at 8.3% in January and at 8.8% in February 2023. Prices of electricity, gas and food and interest rates on mortgages increased as inflation climbed.

In early 2023, many people had difficulties managing daily expenses. In the member survey, respondents shared what methods they used to survive financially. Many are struggling.

– As one male middle-aged member working in the chemicals industry jokes, replacing electricity with firewood for heating and supermarket food with fishing and foraging keeps the mind and body active.

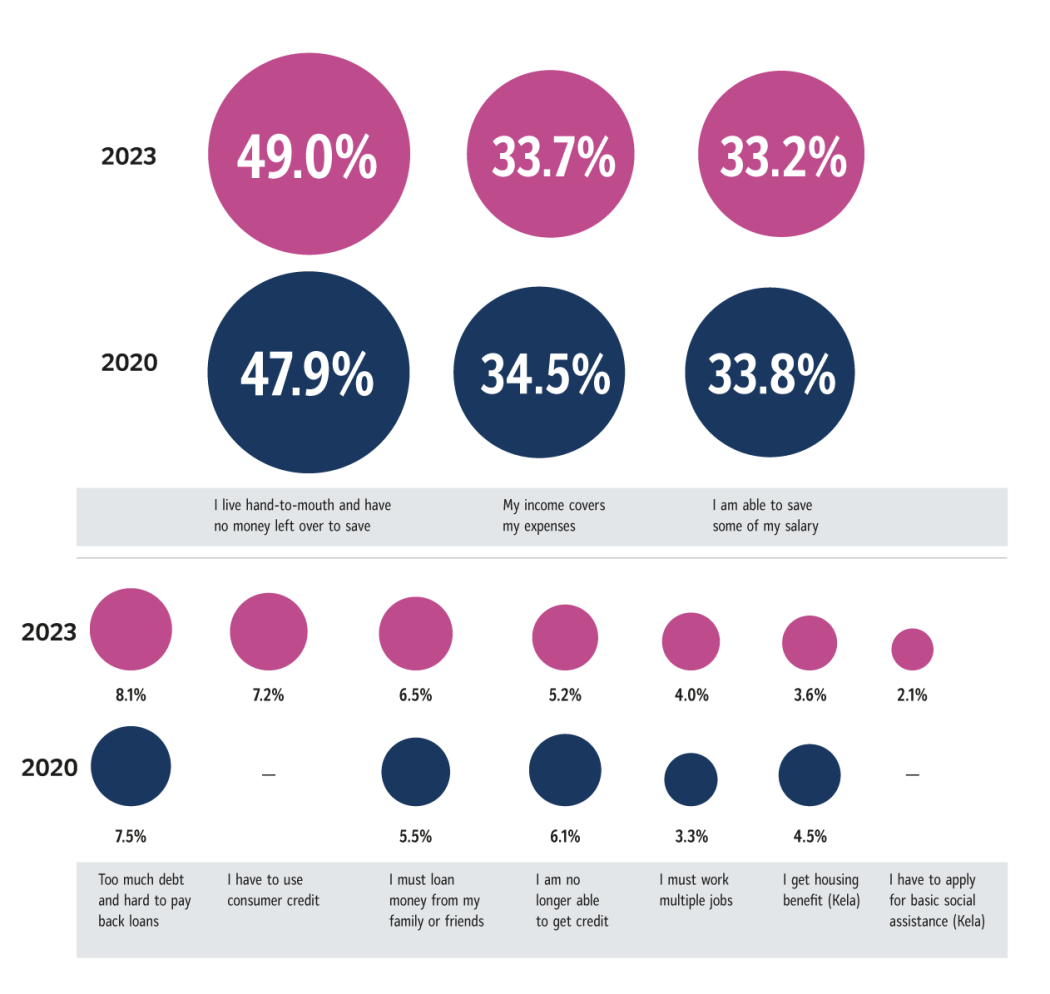

The question “How are you getting by financially?” could be answered with all options that matched the respondent’s current situation. The results show that more than half of respondents are getting by financially, while the other half is struggling.

There has been no major change in the livelihoods of members in three years. This may indicate that expenses can be scaled according to available income, or that the additional expenses are covered in some other way.

Wages are not enough to live on

For about one in ten respondents, earning a livelihood is a struggle. Many are unhappy about their financial situation. Members frequently work overtime to cover increased costs. Nearly everyone has had to make compromises on one thing or another.

– I try to put money away and enjoy the little things, like getting my bills paid. You can forget about holidays and shopping, that’s for sure, says a female member in the chemicals industry.

For many, the current salary or wages are not enough to live on. A relatively large proportion of respondents have taken a consumer loan (7.2%), borrowed money from friends or relatives (6.5%), or applied for housing support (3.6%) or basic income support (2.1%). Some have difficulties making payments on loans (7.2%). Many have defaulted on their credit rating (5.2%) or facing inevitable default in the near future. Divorce, unemployment or illness can lead to worsening indebtedness.

While many older members have paid off their mortgages, things are harder for younger generations and members with families. Indeed, members’ situation in life largely determines how well they are able to manage rising living costs.

– No debt of any kind, children have moved out and live on their own, the wife is also working. Our salaries are nothing special, but we don’t have much expenses either, says an older metal industry worker living in a single-family home.

Some older members support their adult children financially. In some cases, younger members still live with their parents, partly for financial reasons. People who come to work in Finland from abroad may also support family members who live far away.

– I need more extra hours…I’m still sending money to my family, says a young female member working in the other manufacturing sector.